We offer clarity, common sense and total reliability, combined with financial flair.

We will be there for you when you need us with day-to-day issues and your financial administration will be managed proactively by your Client Manager

The world was left dumbfounded last week by President Trump’s sweeping tariff announcements on April 2nd’s Liberation Day – ironically dubbed ‘Liquidation Day’. Only a week later, Trump postponed the implementation of most tariffs for 90 days, with the exception of China, after noting that “people were getting a little bit yippy” and markets were declining. Market commentators have attributed this change of heart to turbulence in the bond market , which has a history of deposing governments (think Liz Truss).

Initially, US Treasuries benefited from Liberation Day. Despite the inflationary element to tariffs, the 10-year US Treasury yield fell by roughly 50bps from its peak in January to shortly after the tariff announcement, as investors undertook a modest ‘flight to safety’, rotating from equities into safer assets. Additionally, other forces added to the downward pressure on Treasury yields, such as lower than expected growth, a greater resultant probability of interest rate cuts, and a somewhat improved fiscal outlook.

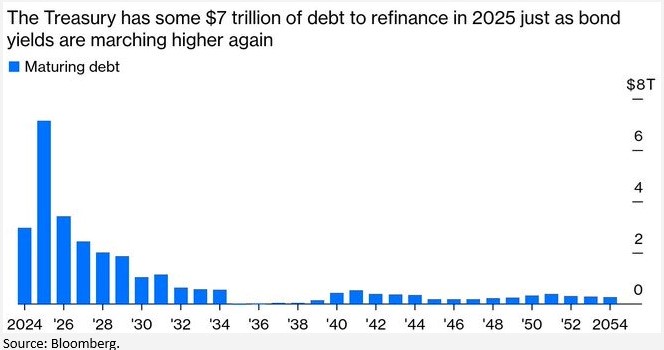

The fiscal outlook and the credit worthiness of the US Treasury Department are important, as this becomes a self-enforcing mechanism. Perceived fiscal prudence feeds into lower bonds yields, which in turn lowers the rate of borrowing, which again improves the fiscal outlook. With roughly half of the US Treasury debt maturing over the next two years (the so-called ‘debt refinancing wall‘), this feature of the US Treasury’s budget may become an increasingly pressing issue.

The debt refinancing wall

US government debt now exceeds $28 trillion, or 98% of GDP as of Q4 data 2024. The budget deficit – the amount by which government spending exceeds government revenue - was $1.8 trillion in 2024 and is projected to reach $2 trillion for 2025, adding to the burden. The US faces a $14.6 trillion wall of maturing Treasury debt over the next two years, with roughly half of this figure due within 12 months. As government debt matures, the Treasury has two options: 1) pay the full amount back in full, or 2) refinance at the prevailing rate. Given there is no fiscal surplus to pay the principal back to bondholders, the Treasury has no option but to refinance. Naturally, this creates a huge incentive for Trump to drive Treasury yields downwards, thereby reducing the interest rate on this debt for several years, before the debt matures. The looming debt wall is shown graphically below:

When the Treasury refinances, it issues a bond with a rate of interest equivalent to the prevailing yield at the corresponding maturity on the Treasury yield curve. If the Treasury wants to finance with a 10-year bond for example, the corresponding rate is the 10-year Treasury yield.

When the Treasury refinances, it issues a bond with a rate of interest equivalent to the prevailing yield at the corresponding maturity on the Treasury yield curve. If the Treasury wants to finance with a 10-year bond for example, the corresponding rate is the 10-year Treasury yield.

To put these large numbers into context, at the current rate of interest, the US government’s interest payments surpassed $1 trillion in 2024, outpacing even defence spending. 22% of the total debt is short-term, which creates significant uncertainty when refinancing is due. The amount in short-term debt is now above the top-end of the recommended range. This has been publicly condemned and promised to be addressed with longer-term financing going forwards by US Treasury Secretary Scott Bessent.

Why have US Treasury yields been moving upwards?

The 10-year Treasury yield spiked from below 4% to around 4.5% by April 11, 2025, reflecting a sell-off in US government bonds. This was unusual, as Treasuries are typically a safe haven during economic uncertainty, but investors appeared spooked by fears of inflation, trade retaliation, and reduced global demand for US debt. The Treasury market is notoriously hard to decipher, given the large array of different forces at work. However, many investors have cited a lack of confidence in US assets, which is reflected by a divergence in Treasury yields and the value of the dollar:

That said, the pausing of tariffs does seem to have stabilised 10-year yields around the 4.5% mark, as well as a strong recent Treasury auction. Structurally, the US dollar and Treasuries are intrinsically integrated in every aspect of the global financial economy, which means that fears of a loss of confidence in US assets are likely overblown, although prolonged uncertainty may chip away at its ‘safe haven’ status. In times of equity market stress, it is not uncommon for bond markets to also show signs of stress, and hence this movement should not be taken as a ‘red warning signal’ in itself. Furthermore, whilst Trump’s behaviour may have been drastic, his tariff plan was well telegraphed during his campaign, and the mounting debt levels of over $28 billion arguably requires a ‘drastic’ action.

Wider portfolio considerations

Whilst times of market stress are unnerving for investors, periods such as these are surprisingly common. While the US region still shows robust growth and earnings data, the premium that US assets once demanded has come under scrutiny, especially as regions such as Europe and Japan, no longer overshadowed by US exceptionalism, are beginning to look more attractive in their own right.

Specifically, US Treasuries remain part of model portfolios via indirect exposure from global bond funds, although this is largely limited to short duration Treasuries which are far less volatile. Our preference remains towards UK gilts, short-duration bonds and importantly ensuring a well-diversified exposure – an approach which has helped to cushion less risk tolerant investors well during recent volatility.

Source: LGT Wealth Management

The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document. LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority.

Essential Wealth Management

1-2 Great Farm Barns

West Woodhay

Newbury

Berkshire RG20 0BP

Tel: 01488 669840

Fax: 01488 669216

Email: [email protected]

Essential Wealth Management is a trading name of Essential Wealth Management and Advice Ltd which is an appointed representative of 2plan wealth management Ltd which is authorised and regulated by the Financial Conduct Authority. Essential Wealth Management and Advice Ltd is entered on the FCA register (www.FCA.org.uk) under no. 518528. Registered office: 1-2 Great Farm Barns, West Woodhay,Newbury, Berkshire RG20 0BP. Registered in England and Wales Number: 04020006.

The Financial Ombudsman Service is available to mediate individual complaints that clients and financial services businesses aren't able to resolve themselves. To contact the Financial Ombudsman Service please visit: http://www.financial-ombudsman.org.uk/contact/index.html

The information on this website is subject to the UK regulatory regime and is therefore targeted at consumers in the UK.

Approved by 2plan wealth management Ltd on dd/mm/yyyy