With effective planning and support, we can help you achieve your long-term financial goals.

Nearly all our clients are referred by existing clients, a testament to our service.

US stocks hit new highs in June, while European markets faced pressure due to political uncertainty.

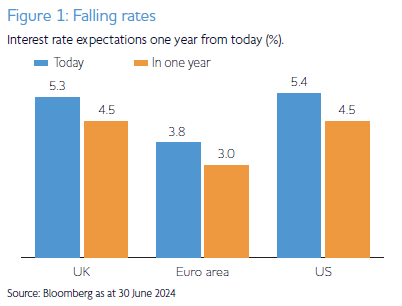

US stocks soared to new highs in June, driven higher by artificial intelligence momentum in the tech sector and inflation nudging downwards, lifting hopes for rate cuts. The US Federal Reserve (Fed) signalled it will cut rates just once this year despite inflation falling from 3.4% to 3.3% in May. The US central bank decided to hold interest rates at 5.25% to 5.5%, where they have been for nearly a year.

The inflation figures will provide a boost to US President Joe Biden who is seeking to convince voters of his economic record in the run up to the election in November.

The US economy remains solid, despite high interest rates. The US labour market created 272,000 jobs in May, which is more than expected. However, unemployment ticked up slightly to 4%. In a notable downshift in consumer spending, US retail sales barely increased in May, rising by just 0.1%.

Bank of England holds rates

UK stocks dipped after hotter than expected inflation pushed back hopes of a June interest rate cut. The Bank of England held interest rates at a 16-year high of 5.25%, despite inflation hitting the 2% target. While consumer price rises have slowed, services inflation, a key metric that is closely watched by the Bank, was higher than expected at 5.7%. As a result, analysts now believe interest rate cuts could be pushed back to September.

The UK jobs market weakened after a surprise uptick in the jobless rate, which rose to 4.4% in the three months to April. Wage growth remained strong at 6% in the three months to April and continued to outstrip price rises. The UK economy recorded no growth in April after wet weather put off shoppers and slowed construction.

ECB cuts rates

European stocks fell after French President Emmanuel Macron called a snap election following a surge in support for the far-right in the 2024 European Parliament election. The European Central Bank (ECB) cut interest rates for the first time in nearly five years, moving away from the Fed and the Bank of England as inflation starts to fall. The cut takes the benchmark rate to 3.75% from a record high of 4%, where it has stood since last September.

Consumer prices in the euro area rose by 2.6% year-on-year in May, up from 2.4% in April. Core inflation, which shows prices without energy and food costs, also rose to 2.9%, up from 2.7% in April. The labour market remains strong despite high interest rates. Unemployment hit a new record low, falling to 6.4% in April, down from 6.5% in March.

Meanwhile, China’s exports and retail sales rose for the second month in a row in a boost for the economy despite growing trade tensions. However, other sectors of the economy painted a less optimistic picture. House prices have suffered their biggest fall in more than a decade despite Beijing’s support measures. Industrial output also lost some momentum. The US has announced a tariff increase on Chinese electric vehicles (EVs) and other goods, while Europe also plans to impose import tariffs on EVs.

Issued by Omnis Investments Limited. This update reflects Omnis and our investment management firms’ views at the time of writing and is subject to change. The document is for informational purposes only and is not investment advice. We recommend you discuss any investment decisions with your financial adviser. Omnis is unable to provide investment advice. Every effort is made to ensure the accuracy of the information but no assurance or warranties are given. Past performance should not be considered as a guide to future performance.

Euro area The Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC are authorised Investment Companies with Variable Capital. The authorised corporate director of the Omnis Managed Investments ICVC and the Omnis Portfolio Investments ICVC is Omnis Investments Limited (Registered Address: Auckland House, Lydiard Fields, Swindon SN5 8UB) which is authorised and regulated by the Financial Conduct Authority.

Approved by Omnis Investments on 2 July 2024

Essential Wealth Management

1-2 Great Farm Barns

West Woodhay

Newbury

Berkshire RG20 0BP

Tel: 01488 669840

Fax: 01488 669216

Email: [email protected]

Essential Wealth Management is a trading name of 2plan wealth management Ltd which is authorised and regulated by the Financial Conduct Authority. 2plan wealth management Ltd is entered on the FCA register (www.fca.org.uk) under reference 461598. Registered office: 2plan wealth management Ltd, 3rd Floor, Bridgewater Place, Water Lane, Leeds, LS11 5BZ. Registered in England and Wales Number: 05998270

The Financial Ombudsman Service is available to mediate individual complaints that clients and financial services businesses aren't able to resolve themselves. To contact the Financial Ombudsman Service please visit: http://www.financial-ombudsman.org.uk/contact/index.html

The information on this website is subject to the UK regulatory regime and is therefore targeted at consumers in the UK.